Mexico.........

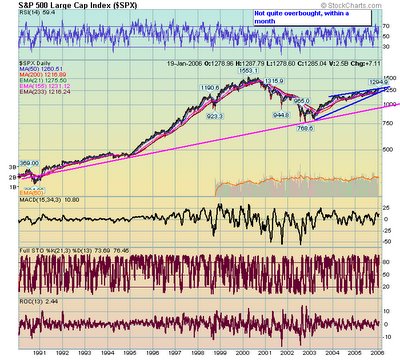

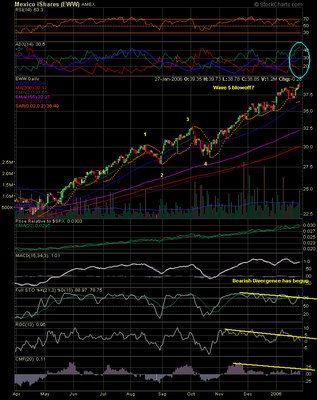

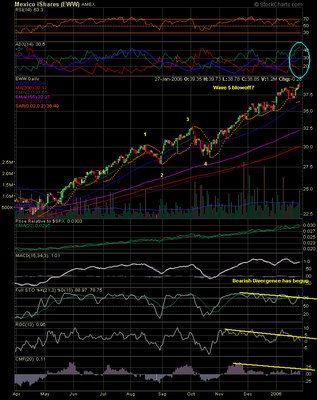

This weekend I was up to my usual sniffing around the usual Blogs and Inet sites and this article came to my attention. So I ran a chart.........the iShares Mexico - EWW.

Notice how the bubble has gone global, first thought. Second thought, what other emerging market segments could also be overdone and good shorting opportunities in the months ahead (more on that later). But back to Mexico, this chart is forming a blowoff top. The P&F chart is still calling for a price of 41.50 - and I will watch this like a hawk in the weeks ahead.

After these charts read the article that caught my eye.

The daily charts is showing signs of bearish negative divergence!

Here is the article:

Here is the article:West

-------

January 26, 2006

NOTE: PLEASE say if you DON'T want your name and/or email address published when sending VDARE email.

ResistingDefamation.Org’s Bo Sears Comments On “Citizenism” vs. White Nationalism

Today’s Letter: A Reader Predicts the Collapse of Mexico

From: John H. Ciccolo, Jr. (e-mail him)

Re: Joe Guzzardi’s Column In Looming Battle Public Relations Battle for Americans’ Hearts and Minds, Mexico Will Lose.

Regarding Guzzardi’s column, the fly in the ointment will be another patented collapse of the Mexican economy.

Consider:

1. PEMEX - peak oil for the Cantarella field will be late 2006 or early 2007. This field accounts for 75% of Mexican oil production. The decline will be swift—10-20 percent per year. Fox just redirected more than $2 billion in exploration funds to political parties for this year's election. Pemex is $43 billion in debt. A friend at Exxon-Mobil says no U.S. major will touch Mexico now because of its corruption. Mexico has received no offers to help explore the promising deep-water Gulf. Mexico can't afford to do it on its own: no money and no expertise. (Of course, because of national pride, many other industries are out of bounds to foreign investment.)

2. Remittances. Understand that remittances are not exclusively an indicator of the number of illegals already here. They are also an indicator of the growth rate of those illegals. Dad comes to U.S., sends money home for a while, wife & kids come (remittances fall or stop). If all Mexicans came here tomorrow, there would be no remittances.

The level of remittances probably reflects the pressure for future illegal immigration. No matter what happens with HR 4437 remittances will plummet over the next three or four years. If open borders wins, family reunification will reduce remittances, if they lose, then senders will return home...either way less money will be transferred south.

3. Drugs. Guzzardi’s suggestion to decriminalize marijuna, if adopted, would collapse Mexico tomorrow. Estimated $128 billion per year heads south from U.S.. This money shows up in U.S. International Statistics as "errors and omissions" and does not show up at all in Mexican accounts, which resemble Al Capone's tax returns.

Take $128 b. + $ $20 b. (remittances) + $10 b. (smuggling) and divide by the total Mexican population and you get $1600 for every man, women and child.

4. Manufacturing. Finally, it is becoming clearer almost daily that India and China are lower cost producers of an increasing number of manufactured products. I first noticed this while assembling computers that I install for cash register systems. First, Mexican modems stopped, then the network cards and now the video cards. Another friend at a Long Island company that designs printed circuit boards (TV cards, video cards, etc.) tells me that nothing has been manufactured in Mexico for at least two years. My auto mechanic claims that many Ford parts originally produced in Mexico now come from China. I believe it is also true that the share of Mexican GDP from manufacturing has fallen over the past decade. That share is only 23% (2004).

The incompetence, xenophobia and corruption of the Mexican ruling class has made it impossible for many hardworking people with the most modest dreams to function in that damned country.

A 1994-like collapse is a foregone conclusion.

The implications of this are appalling: a massive assault on our southern border