WINNING TRADER: Trading the Global Trends

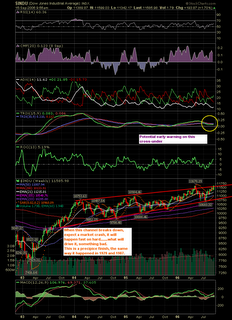

This sites purpose will be to post charts, discuss trends and ideas within the global investment arena. Technical trend analysis will be stressed, parabolic curves, cycles, candlesticks, Moving Averages and overbought RSI, MACD and Stoch. Other technical indicators such as Fib Retracement and Elliott Wave Analysis may also be utilized. Charts tell all about the economic health and overall trend in managing your money. Trade To Win

Friday, September 22, 2006

Friday, September 15, 2006

Precipice Finish

Precipice - The brink of a dangerous or disastrous situation, on the precipice of defeat.....

This is what your FED is fighting, outright deflation and right ahead of November elections. Once this breaks we will have a comeback rally - at what bottom, retest of 10683, more like 10,000 (big technical support here) or even lower 8528 if we break 10,000.

Near term, get out of stocks under:

11032, 10960 and 10900 these are key supports for the month of September.

Once this collapse occurs and it will, we should see a retrace of upwards of 55%, it happened in 1929. But after this retrace expect the final blow to this whole FED created liquidity mess, how low, the Elliott Wave Boys still have a DOW 400 target. Lets just say it will not be pretty.

West