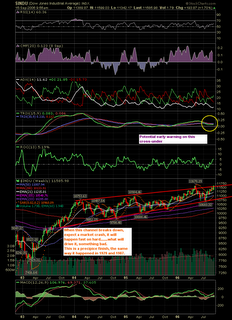

Market fall finished?

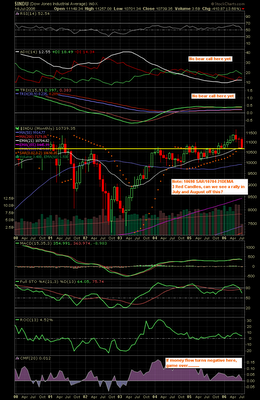

Market collapse over.......charts speak louder than words.

Note what happens everytime we break down in the Blue Circles. (TRIX overbought/oversold)

Get your crash helmets on.

West

http://stockcharts.com/index.html

http://stockcharts.com/index.htmlThis sites purpose will be to post charts, discuss trends and ideas within the global investment arena. Technical trend analysis will be stressed, parabolic curves, cycles, candlesticks, Moving Averages and overbought RSI, MACD and Stoch. Other technical indicators such as Fib Retracement and Elliott Wave Analysis may also be utilized. Charts tell all about the economic health and overall trend in managing your money. Trade To Win

Market collapse over.......charts speak louder than words.

http://stockcharts.com/index.html

http://stockcharts.com/index.htmlCarry Trade - Yen and Swiss Franc: Relation to markets....

There is a theory. It is called the 397 and 403 month cycle.

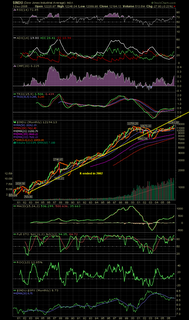

Chart 1 - Real Estate ETF

Chart 3 - Real Estate Short Fund

Not even close, I keep reading everywhere how real estate has topped out. Not until early 2007. My feeling is this top out will be what also leads the stock markets lower.

More on that in another post to follow. Let these three charts determine the real estate top, not the unlimited news feed from every source on the globe. My wife is selling a 35 unit condo project within walking distance to the sea in a market in Europe. Sales are brisk.

Will update on this going forward quarter to quarter.

West